Tax Consultants in this list provide services to multiple postal codes in and around Prince Rupert (i.e V8J 1A8, V8J 1E8, V8J 3T6). For specific service areas, kindly reach out to the individual businesses.

According to statcan.gc.ca the minimum tax consultants costs for homeowners in Prince Rupert, BC is C$88, the average is C$126 and the maximum is C$193.

Tax Consultants in Prince Rupert, BC

(4+)-

Chartered Accountants Tax Consultants

Chartered Accountants Tax ConsultantsBell David S CPA Chartered Professional Accountant is a reputable business located on 3rd Ave W in PrRup. Specializing in corporate and personal income tax as well as estate planning, the firm is dedicated to providing top-notch accounting services to individuals and businesses.…

Address:21 - 342 3rd Ave W Prince Rupert, BCPhone:(250) 624-3975 -

Chartered Accountants Bookkeeping Service Tax Consultants Tax Return Preparation

Chartered Accountants Bookkeeping Service Tax Consultants Tax Return PreparationEidsvik and Associates, Chartered Accountants.

Address:412 McBride St Prince Rupert, BCPhone:(250) 627-1396 -

Tax Consultants Tax Return Preparation

Tax Consultants Tax Return PreparationH & R Block from Prince Rupert, BC. Company specialized in: Tax Consultants. Please call us for more information - (250) 562-6247

Address:201 - 500 2nd Ave W Prince Rupert, BCPhone:(250) 562-6247 -

Chartered Accountants Tax Consultants

Chartered Accountants Tax ConsultantsHugenschmidt Karl from Prince Rupert, BC. Company specialized in: Chartered Accountants. Please call us for more information - (250) 624-6401

Address:103 - 115 8th Ave W Prince Rupert, BCPhone:(250) 624-6401

Search results hints

We looked for the best Tax Consultants in Prince Rupert, BC. Want more options? Consider expanding your search to all of British Columbia.

This list includes only Tax Consultants and related businesses. Each entry provides at least one form of contact information (phone, website, or email).

You will notice that some businesses are marked with a "certified" badge. It indicates that they claimed their profile and were certified by Names and Numbers.

Frequently Asked Questions and Answers

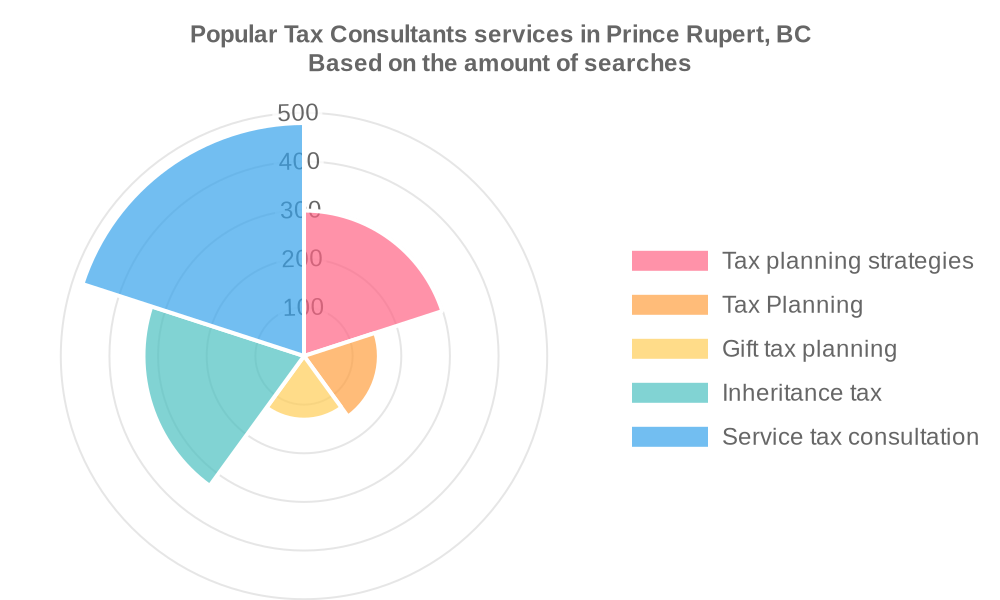

What are popular services for Tax Consultants in Prince Rupert, BC?

Based on our statistics of searches on our website the popular services provided by Tax Consultants are:

- Income Tax Planning and Estimate Calculation

- State & local income tax issues

- Timing of Income and Deductions

- Financial Planning